Introduction/Background

The customer team was challenged with prioritization of clinical development among 3 potential assets for inflammatory bowel disease.

QuantHealth's ability to simulate patients and explore their outome given different possible treatments using AI models trained on very large clinical and biomedical datasets, encouraged the team to explore this technology to run thousands of trials in silico to help define the optimum protocol design.

The customer chose to partner with QuantHealth over internal capabilities and other vendors due to:

Depth of data - A GenAI platform harnessing and combining data from >350M patients and >100,000 drug entities

Platform - An advanced analytics module used by the data science team to simulate novel clinical scenarios for driving insights and prospective evidence generation.

Customer support - A consulting and support team that provided the necessary training and guidance to enable the oncology disease team

Methodology

Patient trajectory across time was simulated for a series of potential IBD trial protocols. QuantHealth simulated the projected outcome of each patient across time for each of the sponsor's potential assets compared to standard care and to control. Simulations for the probability of technical success were then conducted using varying thresholds for targeted effect size and clinical trial size.

Results

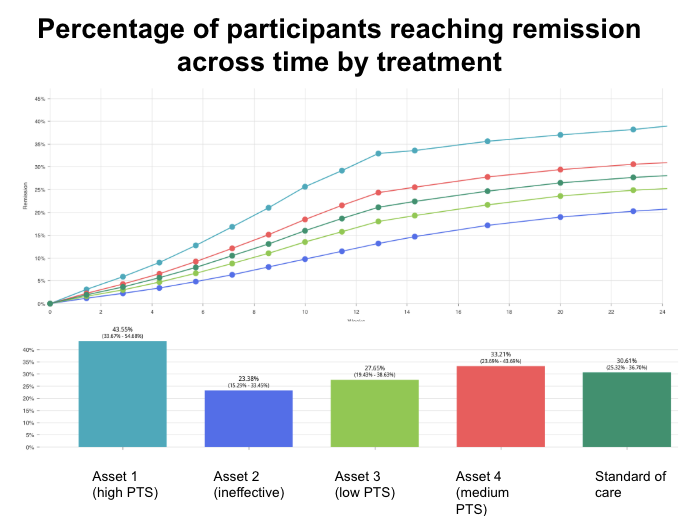

Exploring patient outcomes with each treatment across protocols generated insights for asset prioritization and trial de-risking. Simulation enabled the decision on the asset for clinical development, establishing high probability of success given the optimal protocol and planned trial size.

Net Benefits

Portfolio prioritization led to following gains:

1. More likely to increase remission rate vs standard of care - favorably impacting probability of technical success, regulatory approval, and reimbursement.

2. Two assets were deprioritized, saved 2 Phase II trials (estimated at ~$7.53M each)

3. Reduced number of concurrent competing trials.

Incremental Financial Return

| Operational Gain | Financial Value |

|---|---|

| Two assets were deprioritized | Saving 2 Phase II trials - $15.6M (7.53M per trial) |

| Reduced concurrent competing trials | Operational & resource efficiencies $2-5M |

| Increased remission rate | Estimated revenue uplift $20M–$50M |